Teaching Youth About Money | Part 2

Setting financial SMART goals, calculating compound interest and what is debt?

Financial SMART goals…

What is a Financial Goal?

Financial SMART goals are:

SPECIFIC - state exactly what you wish to buy/accomplish with the money you save.

MEASURABLE - indicate the exact dollar amount you need to accomplish your goal.

ACHIEVABLE - identifgy the steps necessary to reach your goal.

RELEVANT - the goal must be meaningful or you may lose motivation to stick with your plan.

TIMELY - by when do you want to meet your goal?

An example:

SPECIFIC - to buy an iPad

MEASURABLE - will require $520

ACHIEVABLE - if I save $10 per week then I will have saved $520 in 12 months ($500/$10 = 52 weeks)

RELEVANT - an iPad will be useful for homework and doing research

TIMELY - buy an iPad for the Christmas holidays

Activity

Use this template to create your own SMART goal:

The Power of Compound Interest

What is interest?

Interest is a payment you receive in exchange for the use of your money that you have earnt and saved. Interest can also be charged to you when you borrow money. We are going to be investigating the power of compound interest when you save money.

What is compound interest?

Compound interest is interest paid on interest. An example of compounding interest is:

A saving of $100 and 10% monthly interest paid:

$100 saved in the first month

$10 interest paid

$110 balance after the first month

$11 interest paid

$121 balance after the second month

How do you get $100?

You need to do some work for the money you are saving and not spend it on stuff. You can help out your family with jobs, or delivering catalogues, flipping burgers at a food outlet, mowing lawns, odd jobs for an elderly neighbour (ie. taking their bin out and bringing it back in). Pet walking or baby sitting when you are older.

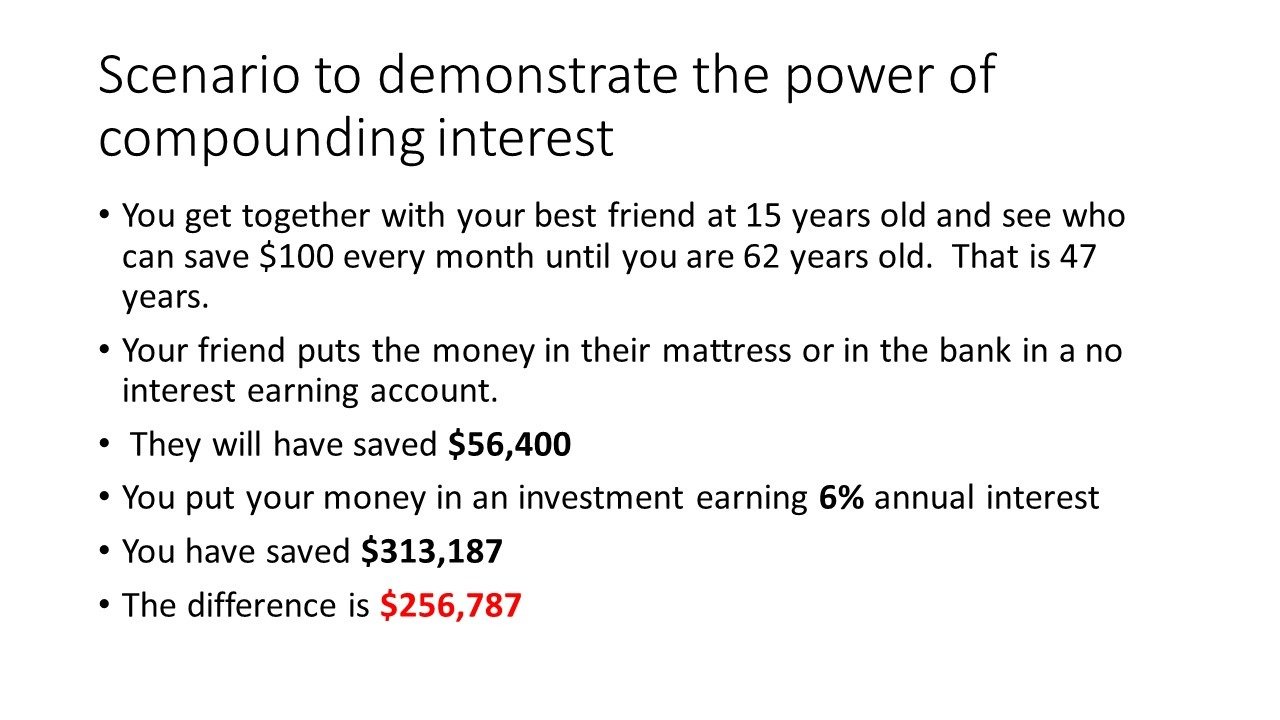

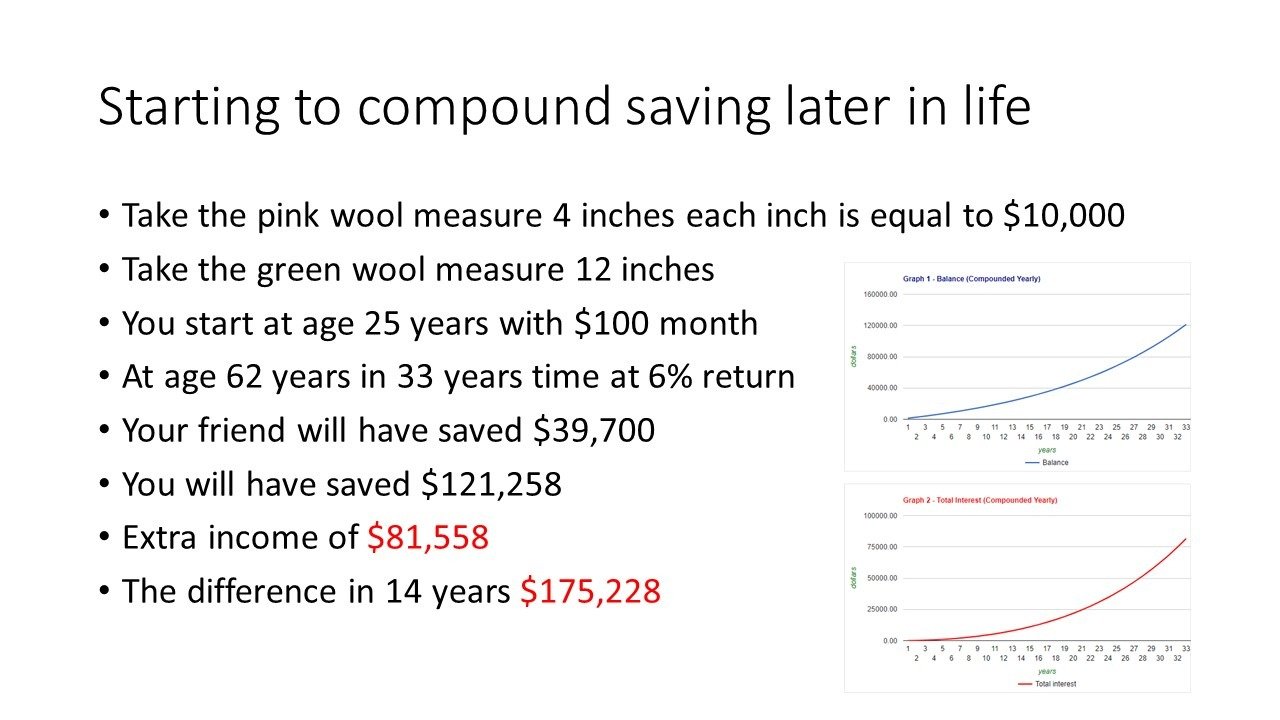

Using 2 different coloured wool, cut one piece of the pink wool 5.5 inches and cut the green wool 31 inches. Each inch is going to represent $10,000 so the pink wool is representing $55,000 and the green wool, $310,000.

You can also watch this video about the power of compound interest and the importance of getting in the habit of saving:

Active Income vs Passive Income

What is active income?

What did you do to earn the money? Odd jobs, helping out at home, birthday money or Christmas money.

You had to actively work for the money in some way or had to be disciplined not to spend the money and save it. To earn the income you took some sort of effort or action to keep adding to your savings.

What is passive income?

FREE money with no effort required. This money was earned when you were watching a movie, having fun with your family or friends, even when you were sleeping. You earn this money without doing anything at all. This is the power of compounding, the interest is growing on the interest earned.

What is Debt?

It is a sum of money that is owed or due. It is the state of owing money. Debt is created when one person (the borrower) owes money to another (the lender) according to a contract.

About debt…

Debt can be used by a borrower to buy something they can not afford right now.

Debt comes at a cost (fees and interest) and borrowers should shop around for the best deal when borrowing money!

Credit cards, Afterpay, unpaid bills, personal loans, car loans, and home loans are all examples of debt.

The Cost of Borrowing:

What happens if I don’t pay my bills?

Credit files

Debt collection

Key Points

Know what you can afford to spend

Save for things you want

Know the actual cost of credit

Know where to go for help

Long term wealth is NOT created by how much you earn, it’s by how much you SAVE.

You can download this presentation here.